- Setting up household budget how to#

- Setting up household budget registration#

- Setting up household budget professional#

Health insurance, for example, would fall under “Healthcare.” The insurance on your vehicle would fall under “Transportation,” and both are totally valid - do whatever helps you feel most organized. Many budgeters will categorize insurance with what exactly they’re insuring. The insurance budget category depends very much on your own, individual preferences. Households can also factor in their “connectivity” expenses, like your cell phone bill, cable or streaming services, and internet expenses. Utilities generally include your gas, electricity, water, and sewage bills. Everyone’s expenses are going to be a little different based on where they live - a household in Syracuse, NY, won’t have the same heating bill as home in Austin, TX. Your utilities category should cover all the expenses that keep these services up and running. Water, electricity, and HVAC (heating, ventilation, and air conditioning) are vital to practically every well-functioning household. This way you can see where your expenses lie in terms of your needs versus your wants. The basic idea behind your budget categories is to itemize each one. However, if you’re a gourmand with a palate for White Stilton and vintage Tawny Ports, you might want to put your non-grocery food expenses, like gourmet foods and wine, into one of the non-essential categories. Many budgeters include grocery shopping and dining out in this category (e.g., restaurant meals, work lunches, food delivery, etc.) Whether you’re grocery shopping and cooking at home, or sampling the culinary scene in your geographic locale, it’s crucial to account for food expenses. While food is a survival necessity for humans, it’s also a budget area for the savvy financial planner.

Setting up household budget registration#

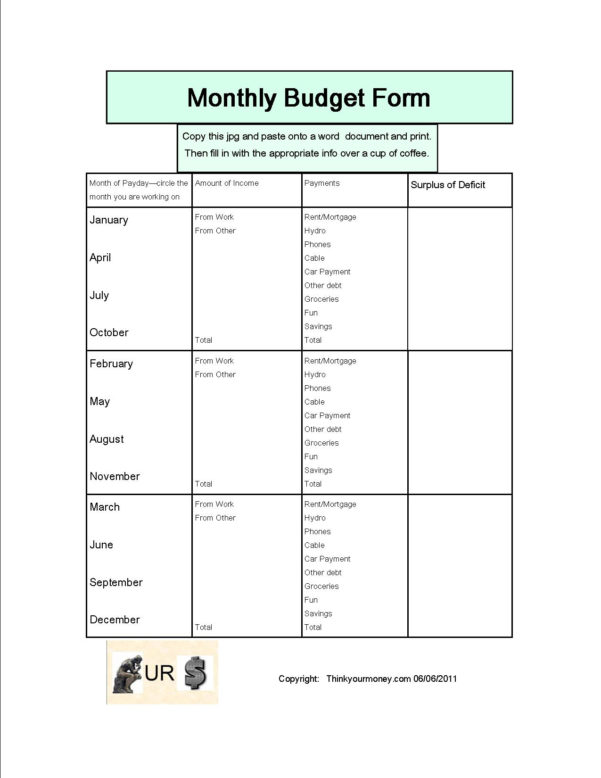

Typically, this budget category includes car payments, registration and DMV fees, gas, maintenance, parking, tolls, ridesharing costs, and public transit. Regardless of your location or lifestyle, everyone needs to get from point A to point B. For most budgeters, this category is by far the biggest. This includes everything from rent or mortgage payments to property taxes, HOA dues, and home maintenance costs. The amount you pay to have a roof over your head constitutes a housing cost. They’re usually categorized under housing, transportation, food, utilities, insurance premiums, and other essential costs. Your disposable income is what you have left to spend on your home budget categories. Assembling Your Home Budget Categories The Essential Budget CategoriesĪll monthly budgets start with your disposable income - we can define this as the amount of money you take home from your paycheck after taxes, retirement savings, and other deductions. It also offers suggestions for how much of your income you can contribute to each category. This guide reviews a list of budget categories found in a basic household budget. Once you’ve identified your basic budget categories, you can start allocating your spending based on your own individual financial circumstances. The first step involves breaking down your regular expenses into budget categories, in order to get a clearer picture of your spending patterns (including areas where you tend to overspend). A well-thought-out budget can help you take control of your finances and use your money with real purpose, so you have enough to pay your bills, grow your savings, and still enjoy life today. Then you can make real-time adjustments as needed by shifting money from one category to another.To put it simply, a budget is really just a plan for your money.

At the beginning of the month, try predicting all your expenses for the next 30 days. Why? Because it forces you to see what you’re spending and increases your likelihood to show more restraint.Ĩ. Many budgeting experts recommend labeling envelopes for categories of face-to-face purchases – such as groceries, gasoline or pet supplies – and stuffing cash into them each month. With those contingencies covered, you’ll feel more comfortable investing a designated amount monthly – something everybody should do in some way, shape or form on a regular basis, even if the investment allotment is small.ħ. Also build in set amounts for emergencies and for “mad money” you can spend any way you want. What’s the most you ever spent on your utility bill? Build that highest number into your monthly budget.

Setting up household budget professional#

You can check counselors’ credentials and be connected to agencies that have made a commitment to certain professional and ethical standards through the and the. Some credit counselors are unscrupulous, though, and you’ve got to be careful not to sink even deeper into debt after seeking such help.

Depending on the seriousness of your debt problem, you may want to get help from a credit counseling agency. Always allot enough money to pay more than the minimum payment due.

Setting up household budget how to#

If you’re reeling from the weight of credit card bills, student loans or other debt, a budget can help you see how to dig your way out.

0 kommentar(er)

0 kommentar(er)